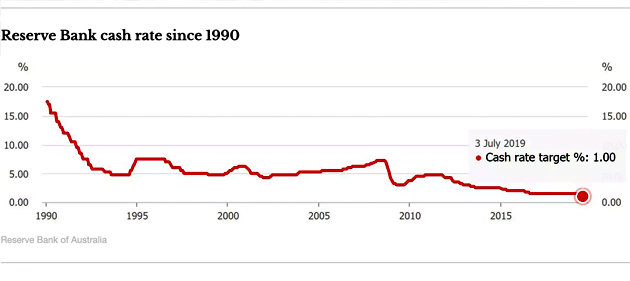

Two cuts in a row, and a good chance of more to come.

The Reserve Bank has cut the official interest rate by another 0.25 percentage points to a new low of 1%, reflecting continuing concern over the slow economy.

Reserve Bank Governor Philip Lowe said the latest cut, which came a month after the RBA made a similar cut of 0.25 percentage points, would help “make further inroads” into the economy’s spare capacity, assist in reducing unemployment, and achieve more progress towards the inflation target. The last back-to-back reduction was in 2012.

Treasurer Josh Frydenberg said the government “expects all banks to pass on the benefits of sustained reductions in funding costs.” ANZ Bank immediately announced it would pass on the full cut. On June 4 it passed on just 0.18 points of the 0.25 point cut.

The Commonwealth and National Australia banks will pass on 0.19 of the 0.25 points. Westpac will pass on 0.20 points for owner-occupiers and 0.30 points for investors with interest only loans.

The Reserve Bank made it clear it could cut further if necessary.

The wording of Lowe’s statement makes clear that he will continue to cut rates until the unemployment rate falls, probably to around 4.5%, which the bank has identified as a target consistent with its inflation target.

Sub-5% unemployment the new RBA target

Over the past six months, the unemployment rate has climbed from 5% to 5.2%, instead of falling as the bank believes it should.

Lowe’s statement says the Australian economy “can sustain lower rates of unemployment and underemployment”. It says its inflation target of 2-3% is not at risk. It expects underlying inflation to climb from its present 1.4% to around 2% in 2020 and then a little higher after that.

After the announcement, JP Morgan predicted another two cuts, taking the cash rate from 1% to 0.5% by mid next year. It said the risks to this view were that the bank “gets there earlier, not later”.

The cut in the cash rate will bring many mortgage rates down to less than 4% for the first time in records that date back to 1959.

The latest Reserve Bank decision comes as the Coalition government gathers the Senate numbers to pass its income tax package this week. The first tranche will provide an early stimulus to the economy.

Frydenberg said the government’s economic plan, “including significant tax cuts of which the legislation will be introduced into the parliament today, will boost household consumption and overall economic activity”.

While the Reserve Bank described the outlook for both the global and domestic economies as “reasonable”, it pointed to uncertainties in each.

The central scenario for the Australian economy remains reasonable, with growth around trend expected. The main domestic uncertainty continues to be the outlook for consumption, although a pick-up in household disposable income is expected to support spending.

Lowe pointed out that while there had been a pick up in private sector wages growth, “overall wages growth remains low”.

Labor puts the case for bringing tax cuts forward

Shadow Treasurer Jim Chalmers said “two rate cuts in two months are a damning indictment of the Liberals’ economic mismanagement”.

Rates are now a third of their level during the global financial crisis of the late 2000s, he said.

Chalmers said the decision to cut rates boosted the case for Labor’s proposed amendments to the tax package. These amendments would embrace the first stage of the tax plan, bring forward some of stage two and drop the third stage.

But the government is insisting the package must go through without change, and is negotiating with the crossbench to bypass Labor if necessary.

In his speech opening the parliament on Tuesday, Governor-General David Hurley said the government believed “a strong economy is the foundation of the compact between Australians and their government”.

“A strong economy makes us more resilient when economic shocks and global headwinds confront our country,” he said, in an address that is written by the government.

My government understands that you can’t take economic growth for granted and it requires continual work – in improving confidence, competitiveness and productivity.

The speech outlined the government’s program but did not contain anything new.

In the first meeting of the Coalition parties in the new parliament, Prime Minister Scott Morrison said he wanted the government to be known for its humility and urged his troops to be humble.

He declared this as “the year of the surplus” – a reference to the budget’s promise of a return to surplus this financial year.

Read more: Rate cuts might hurt, as well as help. What if this man didn’t need to do as much?

Read more: Stages 1 and 2 of the tax cuts should pass. But Stage 3 would return us to the 1950s

Read more: Buckle up. 2019-20 survey finds the economy weak and heading down, and that’s ahead of surprises